Article summation

- Foreigners or nonresidents is also spend money on assets inside the Southern Africa just like the some body, or through joint ownership or because of the obtaining offers inside the an entity you to definitely possesses assets.

- Nonresidents must import fifty% of your purchase price or harmony from purchase price through the Set-aside Lender, from their very own foreign lender so you’re able to a selected account (that can usually end up being the trust membership of move lawyer) that have a registered Southern area African bank.

- All the people from other countries, especially nonresidents, need purchase that rand in the united states for each rand they have to acquire. The total amount people from other countries or nonresidents normally borrow is limited in order to fifty% of one’s purchase price.

This new Southern African property sector continues to be https://paydayloansconnecticut.com/topstone/ a prime attraction to possess overseas traders, thanks to a favorable exchange rate and you may a great amount of luxury casing for the beautiful metropolitan areas. International resource is anticipated to advance raise because discount gradually recovers on Covid lockdowns.

What things to find out about home loans for foreigners during the South Africa

Foreigners maybe not citizen in Southern Africa, who will be enthusiastic to invest in property here, does thus in person otherwise as you, or by getting offers from inside the a family this is the registered manager of a home.

1. If you purchase possessions as a result of an estate agent, they have to be a subscribed member of brand new Estate Agency Affairs Panel having a legitimate Fidelity Fund Certification.

dos. Once you build a deal to buy and is accepted, a contract of marketing was drafted on buyer, seller and two witnesses in order to signal. Which offer was legally binding. When the possibly the customer or supplier cancels the fresh contract on 11th time, they can be sued to own expenses obtain, such as for example wasted judge fees.

step 3. Both provide to find together with agreement away from deals demands to be comprehended prior to they are finalized and you can submitted. It is best to look for separate legal advice when the anything are unclear.

cuatro. Property into the South Africa is available voetstoets (as well as). not, the customer need to be told of the many patent and you may hidden faults regarding the property.

5. Accessories and accessories was instantly within the purchases of one’s property. To have clarity, these can end up being placed in this new agreement out-of purchases.

six. Electrical and you will beetle permits are required to make sure the brand new electricity construction are agreeable which have legal criteria and that the home try maybe not plagued by specific beetles. (The second certification can be merely required from inside the seaside nations.) Specific places require plumbing system and you can gas licenses.

seven. All of the foreign people perhaps not resident otherwise domiciled when you look at the South Africa must invest one to rand in the nation for each rand they want to borrow. Extent people from other countries or low-citizens can be obtain is bound to 50% of the cost. Acceptance are required because of the change control bodies, that will believe being able to confirm the latest introduction in order to Southern Africa of an amount equivalent to the connection loan amount.

8. Banking companies will only money 50% of your purchase worth of the house or property to own nonresidents. So international buyers have a tendency to possibly need provide a great fifty% deposit, otherwise shell out bucks and you will expose an entire amount into the South Africa through the Set-aside Bank in order to a designated checking account (that will constantly end up being the faith membership of the animated attorneys) with an authorized Southern area African lender.

nine. The latest record of your deposit of the loans gotten from a international resource is known as a great contract receipt and really should getting chose by purchaser as it is needed toward repatriation out-of loans if the property is fundamentally ended up selling.

ten. If it is a joint application, at least one candidate have to secure at least R25 000 30 days, getting 18 decades otherwise older and also have an obvious credit score.

Exactly what records can i need when applying for a mortgage just like the a foreign investor?

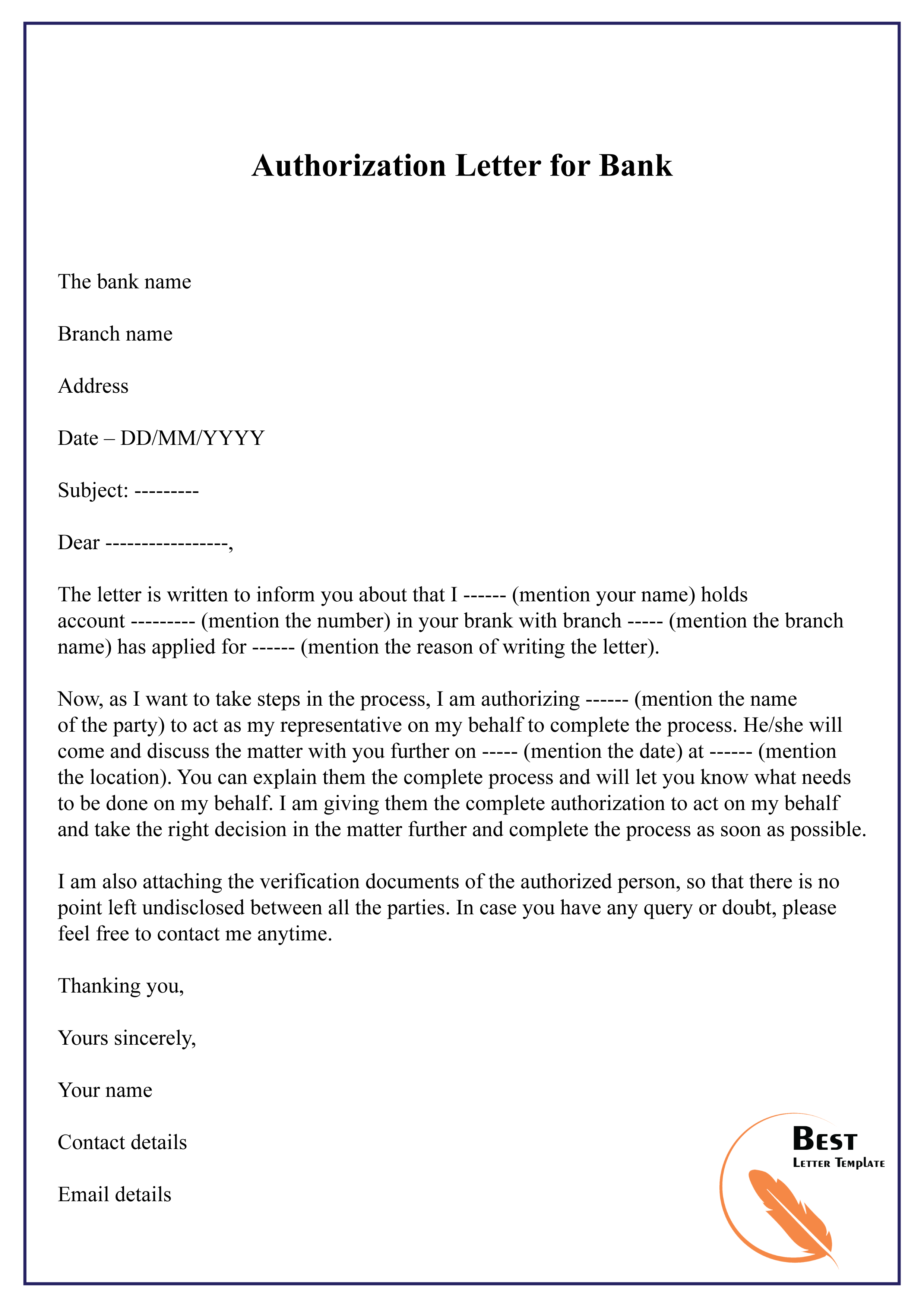

- A customer Home loan Interview Mode, closed and you will dated. Rather you could potentially done an online app that have ooba Home loans:

- A copy of one’s ID otherwise each party off an enthusiastic ID Cards Otherwise a foreign or South African passport Otherwise a work allow letting you really works abroad.

- A paycheck Suggestions Otherwise a payslip for the latest half a year (up to submission go out).

- A duplicate off a complete Package of A career.

- A consumer Financial Interviews Function, closed and you can old. Rather you can done an online software having ooba Mortgage brokers:

Trying to get home financing using a-south African bank

ooba Lenders is actually South Africa’s premier mortgage research provider, and can help foreign people to buy possessions for the Southern area Africa after they submit an application for a bond as a consequence of a-south African standard bank.

Potential customers you should never always have to discover a banking account with you to definitely commercial bank, because they can import money straight from the to another country account to the their residence loan account.

We are able to submit the application to several Southern area African banking institutions, enabling you to contrast packages as well as have a knowledgeable contract to the your residence financing.

I supply a variety of equipment that may result in the property procedure easier. Begin by our Bond Calculator, up coming explore all of our Bond Signal to see which you can afford. Fundamentally, before you go, you might submit an application for a mortgage.

Yorum Yapılmamış