In search of your automobile are (and appropriately will likely be) an excellent heck of numerous out of enjoyable. Comparing all of the different solutions and you will attempt driving each one of the prospective designs, next selecting the one that’s effectively for you and obtaining in the driver’s seat of the glossy experience, breathing the latest distinguished the brand new car odor… There are few most useful thoughts online.

You will find although not a number of common errors that are made when you are considering the credit side of things. When you’re looking for another type of vehicle and want to make sure you do not end in identical boat (up the exact same creek in the place of a paddle) given that a lot of anyone else before you can, take note of the adopting the 9 most significant mistakes anybody make having auto loans.

1. Wishing till the stop to sort out financing

When you are with the hunt to have a unique automobile, loans Burlington CO there are a lot what to remember that anything can certainly sneak your head. Away from creating every browse and you can learning up around possible regarding the patterns you are interested in so you’re able to looking around to own an informed rates, the newest negotiation techniques therefore the umpteen anything on it, initial piece of the latest to get cake – money – normally be anything from an enthusiastic afterthought.

Since it is undoubtedly the key to to invest in a unique car, its vital that you work on funding to start with. You don’t want to love an automobile just to learn that you may be not able to safer money for this!

dos. Neglecting to get a resources along with her

If out of a car loan otherwise other things in life, living better more than the mode (aka wine into a beer funds) have major outcomes. All it takes is that unanticipated state hence need instant monetary attention to toss what you off-balance.

Stop that it by the sitting down and you will putting a resources with her. This can tend to be all uniform month-to-month credit (elizabeth.g. salary) and you may debits (elizabeth.g. costs, current loan repayments, an such like.) and dealing out how much was left-over. Doing this makes you regulate how far you could easily manage, that may up coming determine that makes and you can models fall within your rates class.

step 3. Becoming unacquainted with exactly how fit (or substandard) your credit rating is actually

If you’re not round the where your credit score lies, now is local plumber to find out. It is very important see your credit rating before you apply having financial support since a less favourable get have an effect on your rate of interest, and could better restrict your choices of loan providers and you will finance bundles.

To ascertain your credit score, you might order a free of charge credit history from several locations as well as Experian and you will Equifax, as well as in so it statement might be just your credit score but details about established finance, non-payments and you may borrowing checks you have undertaken.

Then you can remark their report to know if you will find one errors. In that case, be sure to take the appropriate steps to have this type of remedied because usually replace your credit history. Also remember to blow all your debts/loan repayments on time, and you will minimise exactly how many borrowing monitors try conducted up against your own label.

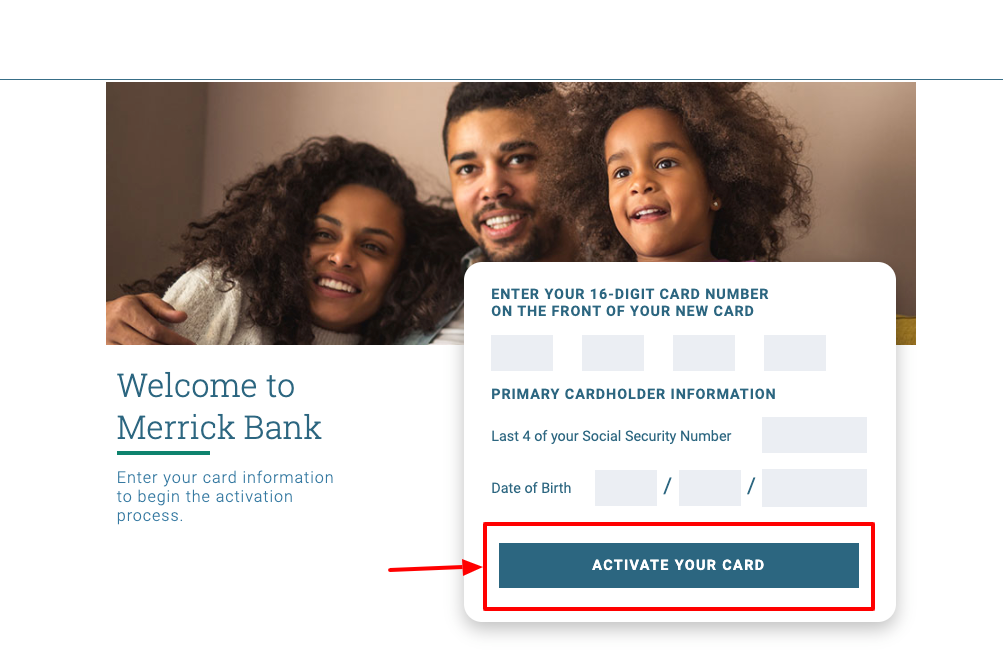

4. Without having pre-recognition before-going vehicles looking

Going into dealerships devoid of pre-approved financing feels like paddling to your Teahupoo without knowing how to surf: you are getting broke.

Ensuring that you dealt with finance pre-acceptance will give you the upper hand from the moment your action ft towards vehicles showroom; brand new sales agent can no longer apply the funding deals’ to further confuse one thing when the time comes so you’re able to discuss and you can be certain that they’re getting the bottom line selling rate of one’s vehicles off which have no tobacco and you may decorative mirrors.

Yorum Yapılmamış