15-Year Repaired

15-12 months fixed mortgage, as well, was a terrific choice for people who wish to pay-off the finance quickly. People also can save money ultimately and savor lower rates which have good 15-year fixed financial. Right away of one’s mortgage, less money try spent on interest than simply which have 30-year fixed mortgages. As an alternative, repayments rather slow down the dominant per month.

Having said that, you will need to recognize that fifteen-season repaired mortgages include higher monthly installments than simply 30-year repaired mortgage loans. Therefore, it is not always the first choice to own people who would like to make use of their money in other places if you find yourself carried on to repay their finance.

Most other Repaired-Rate Financial Terms

If you find yourself 15- and you may 30-seasons repaired mortgage loans certainly are the best solutions certainly homebuyers, they’re not really the only a couple of alternatives. Investment Financial now offers good 10, 20, and you may 25-12 months fixed-speed mortgage plus one called an effective variable rate mortgage.

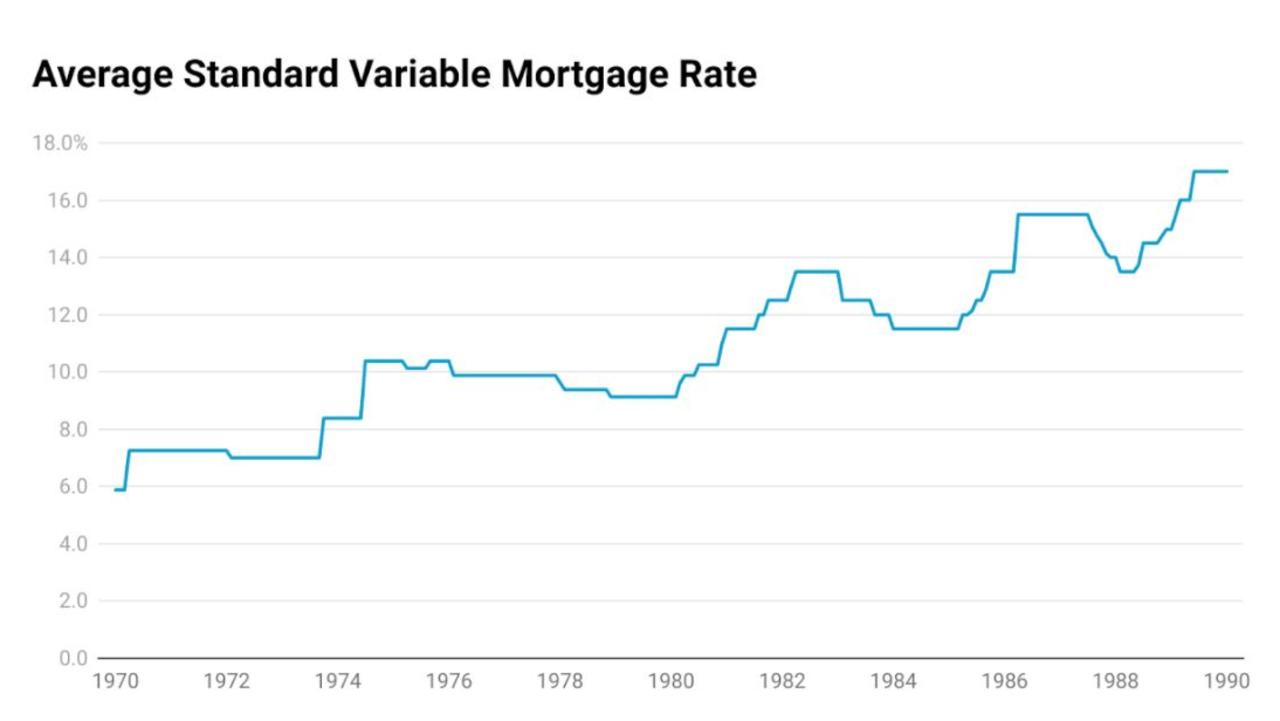

A variable rate mortgage varies based on newest rates of interest. Accordingly, they could raise due to the fact cost increase and drop-off as the rates drop. Which home loan can also be basically be closed in the after five so you can seven many years. Ergo, he could be an ideal choice whenever interest rates is actually falling.

Conventional Mortgage Criteria and you can Certificates

Any potential house buyer understands that to shop for property does not happen quickly. There are some mortgage standards and certification that must be fulfilled to become acknowledged. When you find yourself these requirements may seem restrictive, he is designed to make certain you can easily generate the home loan repayments across the lifetime of the borrowed funds. Another guidance actually leads to potential buyers’ capacity to be acknowledged for a loan.

Amount borrowed

It might seem apparent, however the basic piece of guidance that the lender should determine one which just become acknowledged for a loan is the loan amount. The debt-to-income proportion is among the fundamental affairs that dictate how much cash you might acquire.

That it profile was determined from the separating the brand new client’s monthly gross income of the their level of personal debt. Fundamentally, an effective 41% or all the way down obligations-to-earnings ratio try desirable. Understand that every lenders should include the possibility financial whenever figuring your debt-to-income proportion.

Down payment

A different component that identifies the new information on that loan is the fresh new down-payment. An advance payment refers to the dollars that’s paid-up-front getting a home. With regards to the variety of mortgage, a downpayment ranges away from step three% of one’s home’s business rates to 20% of one’s product sales rates to own a traditional mortgage.

Big off costs have a tendency to bring about so much more advantageous rates. You will need to keep in mind that down payments dont include closure will cost you, which is ranging from dos and you may 5% of the home’s business speed.

Credit rating

While you are there is absolutely no hard-and-punctual code you to suggests just the right score locate an effective real estate loan, certain criteria occur. In the event the credit rating is lower than 620, you’ve got complications getting financing.

Such, credit scores anywhere between 620-760 usually trigger practical rates, if you’re ratings more than 760 always receive the best interest rates. While you are a good credit score is helpful so you can safe a good loan, to shop for a property continues to be possible with a less-than-prime score.

In the end, a predetermined-rates mortgage is the right one for you for folks who need an everyday, secure mortgage. Selection vary from bank in order to financial, however the most commonly known repaired-rate funds is fifteen- and you may 29-seasons mortgage loans.

Funding Lender has the benefit of a 10, 20, and 25-season fixed-rate mortgage and you may an adjustable-rate home loan. Of the offered how fast you want to pay off your own home loan – and at what rate of interest – you might see whether or perhaps not loan places Mettler a predetermined-price mortgage suits you.

30-year mortgage loans create consumers to build up the savings, old age funds otherwise children’s degree fund. What is more, consumers that have a 30-12 months repaired mortgage is elect to pay extra monthly in order to slow down the principal to their financing.

Yorum Yapılmamış