Wisconsin FHA Loan Standards & Constraints to possess 2024 from the County

To simply help homeowners inside the Wisconsin, you will find government-backed applications and make to acquire a house less expensive. The newest FHA home loan system has the benefit of people a nice-looking loan you to makes to find a home simpler.

Many reasons exist as to why choosing an FHA mortgage you certainly will end up being your best bet, however, you will find some limitations with this type of mortgage. You’ll find financing constraints and other regulations that have to be observed whenever making an application for an FHA home www.elitecashadvance.com/installment-loans-pa/denver/ loan.

The advantages of Opting for an FHA Home loan

Should you choose this new Wisconsin FHA program, you could potentially purchase your house with just good step three.5 % deposit. If you find yourself you will find benefits to large off costs, rescuing ten% otherwise 20% of one’s price out of property could take ages. This may slow down you from to buy and mean might continue to spend rent for over you prefer. But that loan supported by the newest FHA you will enables you to buy your domestic sooner or later.

You can acquire assistance from all your family members to boost your off commission, as well as the supplier are permitted to subscribe to the closing costs too. The seller offer as much as 6% of your own price of the house to help the consumer that have the expense. This can be acceptance of the FHA and can getting discussed which have the seller when they ready to help these costs.

To fund their deposit, currency may be used from savings membership, old-age assets, and. Make an effort to give documents on the lender to demonstrate where it money originated, not. Without having enough currency spared for a downpayment, relatives or household members also provide finance, though this should be noted also. There could even be help supplied by low-profit enterprises you to definitely provide money to possess off costs.

If for example the credit score isn’t finest, the FHA allows down scores down seriously to 500. No matter if if your score try not as much as 580, you will need an advance payment away from 10%, whether or not not all lenders will approve your loan even then.

Whether or not an FHA financial are going to be better to feel recognized to own, there are specific conditions you should meet and mortgage limits to consider before you apply.

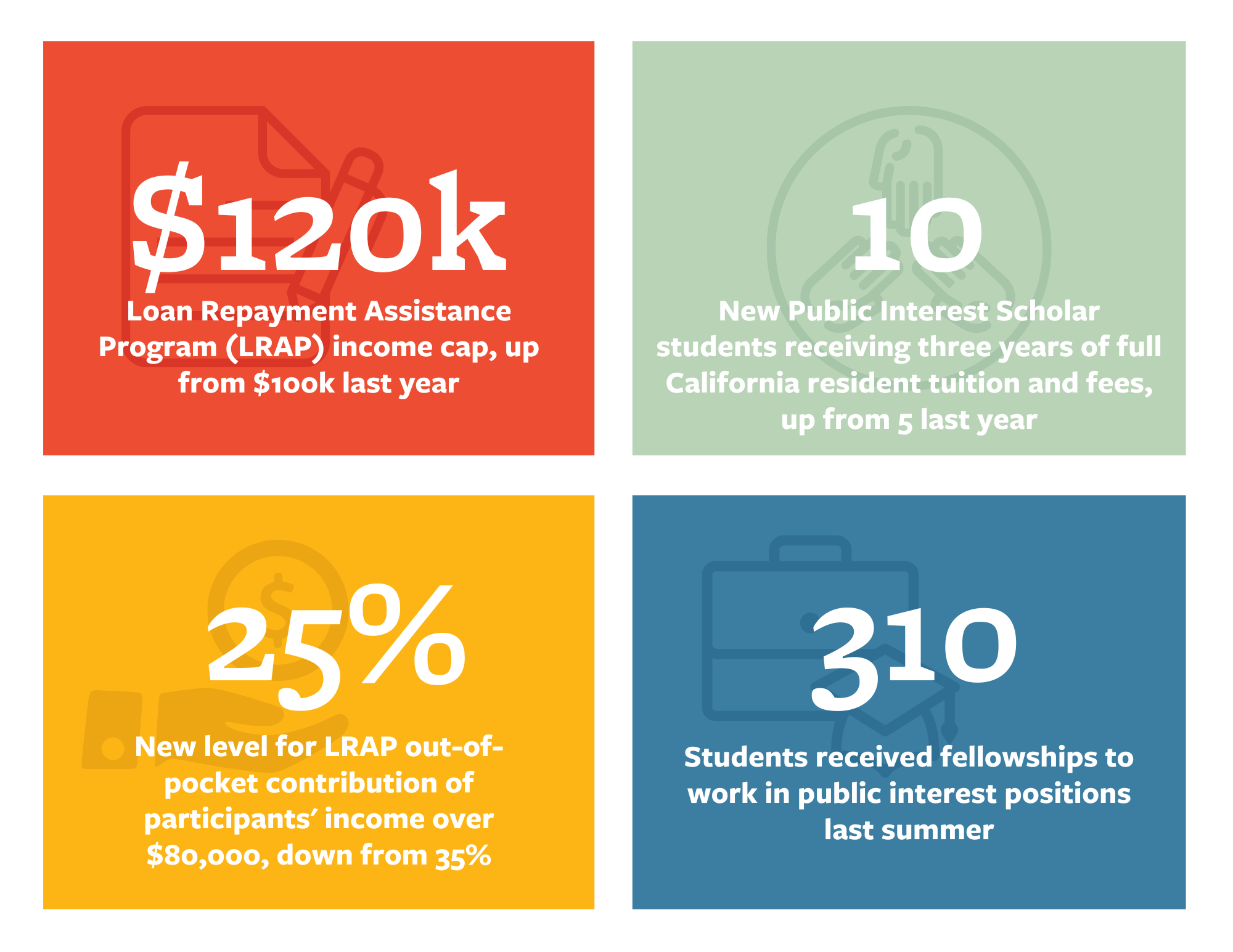

2024 Wisconsin FHA Financing Restrictions from the Condition

A keen FHA mortgage limitations how much cash that may be provided so you’re able to pick a property. Even although you has actually a massive downpayment and you may high borrowing, financing above the limit with the condition will not be acknowledged.

In the most common counties, this new restrict is actually $498,257 to own a one-house. The only exclusions compared to that is actually Enter and you can St. Croix Counties that have the highest median purchases rates. In Penetrate and you will St. Croix Counties, new average transformation price is $442,000 and you may closer to the mortgage maximum than in other counties. Hence, this new limit are high and then make to purchase having a keen FHA domestic mortgage you’ll.

How are the FHA Loan Limits for Wisconsin Set?

The loan limits are prepared of the You.S. Institution of Property and Urban Creativity (HUD). Brand new HUD uses investigation on the Government Construction Money Agency (FHFA) as well as their House Rates Directory statement. This enables changes in family costs becoming tracked therefore the FHA mortgage constraints adjusted correctly.

Qualifying to have a keen FHA Loan during the Wisconsin

If you want to pick a property into the Wisconsin having a keen FHA mortgage, there are certain requirements that you ought to satisfy. Not simply do the home need to be when you look at the loan restrictions revealed a lot more than, however the after the conditions should be came across as well:

- 49 Offers

Yorum Yapılmamış