Underwriting simply a really love technique for saying, What are the potential it currency I am credit return for me and you can just what principal site dangers are worried?

At the its center, there’s two more techniques from inside the underwriting. Another approach might be discover within individual money lending and is situated more about the latest underwriting otherwise risk comparison of house by itself.

Truth be told there can be a great deal more records on the old-fashioned lender station, although cost and you can terms are even more advantageous towards the borrower. On the other side, the rate off underwriting and you may characteristics out-of financing running privately money have a much some other end up being. Each other types of underwriting live in the newest financing globe. The option of and therefore path to take boils down to home loan originators undertaking the proper search to determine which type of financial and you can tool are working good for for every single customer’s particular disease.

Bank and nonbank underwriting

Very residential consumers have the antique underwriting route as a result of a financial otherwise a beneficial nonbank bank, because most anybody just rating a mortgage loan when purchasing its prie can’t be said the real deal home dealers exactly who, once they need financing, normally read a private money-lender. In either case, it is important to own financial originators to simply help its consumers know how underwriting works and you can the proceedings.

While you are a domestic financial originator, that it reasons might be easy when writing on a timeless household loan. Underwriters at the financial institutions and nonbank loan providers often concentrate on the borrower. The fresh house itself has to meet some basic conditions, but the stamina of your borrower’s cash and you may power to pay off the borrowed funds tends to be heavily adjusted in the exposure research.

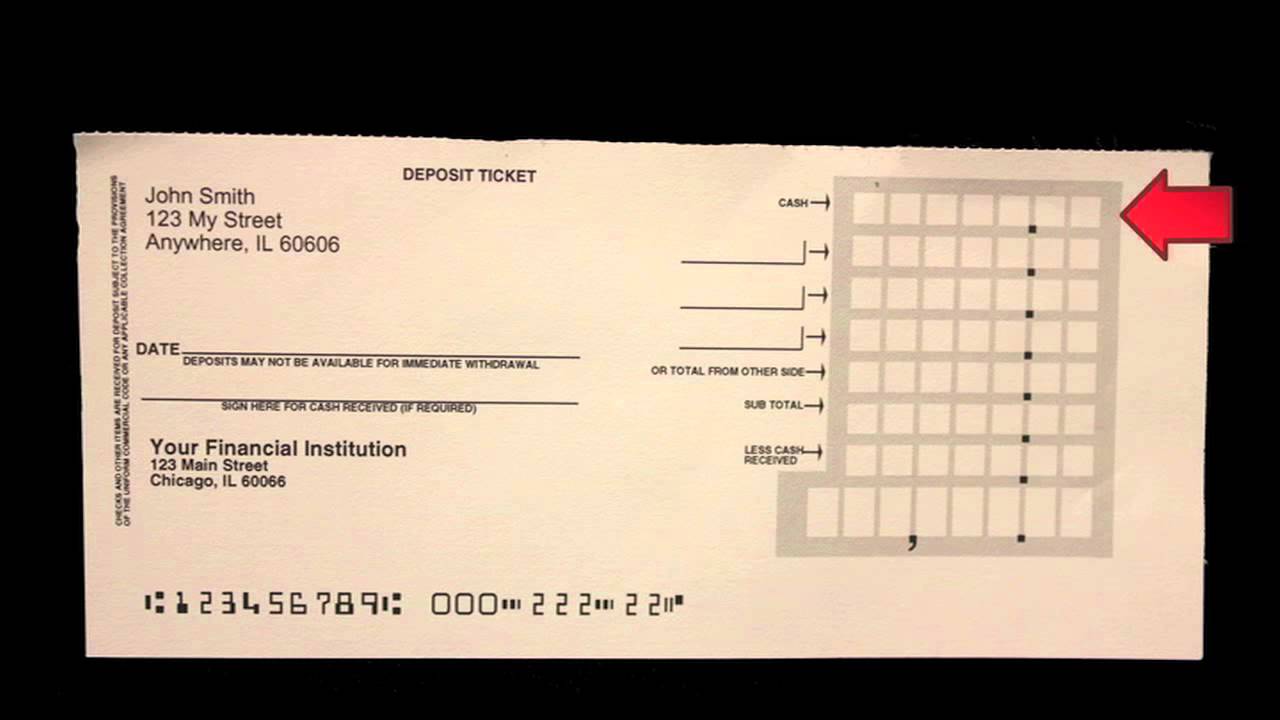

A great time to possess so it dialogue happens when you are completing a software which have a debtor. The standard underwriting procedure means an abundance of records, so it is important for individuals to be aware upfront out of what’s going to be needed from their website once the application for the loan actions through the techniques.

Really originators that do plenty of loans can get a great market it specialize in, so that they have developed a romance and you will understanding towards specific bank that underwrite the mortgage and so are regularly their underwriting measures. This allows to own a soft changeover ranging from originator and financial once the well once the obvious expectation form into borrower.

When doing a traditional financing, ensure that your individuals comprehend the importance of things such as borrowing from the bank, stated money and you may tax returns, which could play a primary part from inside the deciding if the they’re going to get the mortgage. Even though some loan providers for example that have their own variety of models completed, underwriting variations are usually standard into the loans offered in order to Fannie Mae and you will Freddie Mac computer. These standard versions enable it to be convenient within the underwriting strategy to assess things like mentioned revenues, debt-to-money percentages plus the bills of one’s borrower.

Real individual and hard money fund would not need W2s, tax statements, lender statements and other records about the latest borrower’s financial predicament like a lender means.

There are disadvantages so you can referring to traditional underwriting for borrowers and you will originators, yet not. The mortgage techniques out of app in order to closure is generally a bit lengthy since there is a lot of swinging parts one to all need certainly to line up perfectly for the mortgage so you can become acknowledged. The traditional loan underwriting techniques in addition to tends to fail individuals which keeps imperfections inside their personal money as it centers thus greatly into the the individuals products.

Private money underwriting

The fresh new underwriting performed regarding private money otherwise difficult currency globe is much simpler on the borrowers who don’t possess primary borrowing and financials. Additionally would be done a lot more quickly, which might be advantageous, especially in the realm of real estate investment. Of many originators pick private currency underwriting easier to deal with because the really because it is greatly resource-motivated and requires nothing files to acquire an exchange to the dining table.

New downside to it area of the wall is the fact appeal rates in the banks and you can nonbank lending establishments are more advantageous than in the realm of personal currency. Personal currency and difficult money also are not habits one to typically scale-up in order to a nationwide top. Very individual loan providers will have below $ten billion to deploy every year and you can, most of the time, they usually have their necessary documentation, underwriting processes and you can exposure review into the a presented price.

Home-based home loan originators would do well for a few individual currency loan providers inside their circle-in instance a deal falls due to with a timeless money provider that they wish to conserve, or if he’s got members who are in need of in order to secure investment easily – such as for instance consumers competing towards property in an exceedingly rigorous housing industry.

Regarding underwriting, private money loan providers generally put a noticable number of weight to the the offer by itself. As well, the fresh new forms and information you to definitely a maker will have to upload having underwriting are different generally regarding bank in order to lender.

Individual currency underwriting isnt an effective plug-and-play process. For each private bank gets its required models and you may/otherwise distribution techniques. Specific lenders try rigorous towards files they receive out of originators while some aren’t.

Correct individual and hard currency finance won’t need W2s, tax returns, bank comments or other files associated with this new borrower’s finances eg a bank needs, yet not. The reason being, occasionally, brand new underwriter is also the lender which is sooner investment the brand new loan, so that they need to make sure that new advantage are purchased is the first line out of protection facing loss in case this new debtor cannot pay.

Both private financing and you may old-fashioned organization lending have its put in the retail and you will investment world. The new underwriting techniques of these a few some other credit systems is really so far apart which they should really has actually more terms. One of the main differences when considering the 2 investment routes, but not, would be the fact conventional money centers much more about the new debtor compared to the asset, once the individual money channel sets far more emphasis on the brand new advantage by itself whenever deciding the danger testing.

Publisher

Ian Walsh is actually vice president of Tough Currency Bankers LLC. He’s come the full-big date a property buyer just like the 2009. The guy registered a by building WeSellHomes2Fix. After that, the guy founded a property-government team that was sold in 2015. While in the his time in brand new Philadelphia financial support industry having Difficult Money Lenders, he’s got underwritten money throughout the East Pennsylvania and Southern Jersey markets.

Yorum Yapılmamış