Adam Hayes, Ph.D., CFA, is actually a monetary copywriter which have fifteen+ years Wall Street experience due to the fact a good types trader. In addition to their thorough derivative trading systems, Adam is a specialist inside the economics and you may behavioral finance. Adam gotten their master’s when you look at the economics throughout the The fresh new University for Social Search with his Ph.D. in the School out-of Wisconsin-Madison in sociology. They are an excellent CFA charterholder together with carrying FINRA Series eight, 55 & 63 permits. He currently reports and you can teaches monetary sociology and social knowledge out of financing from the Hebrew School in Jerusalem.

Federal national mortgage association, the new Federal national mortgage association (FNMA), are a national-sponsored corporation (GSE) chartered from the Congress so you can activate homeownership and provide liquidity towards financial markets. Created in 1938 inside the Great Depression within the The latest Contract, Federal national mortgage association facilitate lower- so you’re able to modest-money consumers see resource to have a house.

Trick Takeaways

- Fannie mae is actually a federal government-paid firm (GSE) produced by Congress.

- Federal national mortgage association doesn’t originate loans to own residents but buys and you may promises mortgage loans from second mortgage markets.

- By the investing in mortgages, Fannie mae creates so much more liquidity to have lenders, together with banking institutions, thrifts, and you can borrowing unions.

- Federal national mortgage association and you may Freddie Mac computer nearly folded in the midst of the newest 2008 financial drama however, were bailed aside and put in government conservatorship.

Just what Federal national mortgage association Do

Instead, they features loans moving so you can lenders by purchasing otherwise encouraging mortgages awarded from the credit unions, banking companies, thrifts, or other creditors. By the investing in the borrowed funds market, Fannie mae brings exchangeability to have loan providers, permitting them to underwrite or financing a lot more mortgage loans. During the 2022, Fannie mae considering $684 million inside exchangeability into financial field.

It is 1 of 2 large people regarding mortgage loans regarding additional industry. One other are its sister Freddie Mac, or even the Government Financial Financial Enterprise, as well as a good GSE chartered of the Congress. After to buy mortgage loans to the secondary sector, Fannie mae pools them to mode a mortgage-recognized safety (MBS). An enthusiastic MBS are a valuable asset-recognized shelter protected by the a home loan otherwise pool regarding mortgages.

Fannie Mae’s financial-backed bonds are ordered because of the associations, such as for instance insurance agencies, your retirement funds, and you will financial support financial institutions. They pledges repayments out-of dominant and you may notice to the the MBSs. Federal national mortgage association also has an organised collection, and this spends with its own or other institutions’ home loan-recognized securities. Fannie mae items debt, entitled company personal debt, to cover their retained profile.

History of Fannie mae Stock

Federal national mortgage americash loan West Vero Corridor association could have been in public places traded given that 1968. Up until 2010, they exchanged towards the Ny Stock exchange (NYSE). Following the Higher Recession and its own influence on the fresh housing industry, Federal national mortgage association was forced to delist its offers to own inability so you’re able to meet up with the minimal closing rate specifications required by the NYSE. Federal national mortgage association today positions over the counter.

Inside the 2008, Fannie mae and you will Freddie Mac ran beneath the conservatorship of your own Government Casing Funds Agencies (FHFA). In , new Treasury and you will FHFA anticipate Fannie mae and you may Freddie Mac to help you continue its income so you’re able to shore up their resource reserves since a good action on transitioning the two of conservatorship.

Fannie mae Loan Requirements

The mortgage loans that Federal national mortgage association instructions and you may promises must see tight conditions. The fresh restrict, put from the FHFA, to have a traditional loan to have one-home from inside the 2023 was $726,200 for almost all parts and you may $step 1,089,three hundred to own higher-costs elements, also Hawaii and you may Alaska.

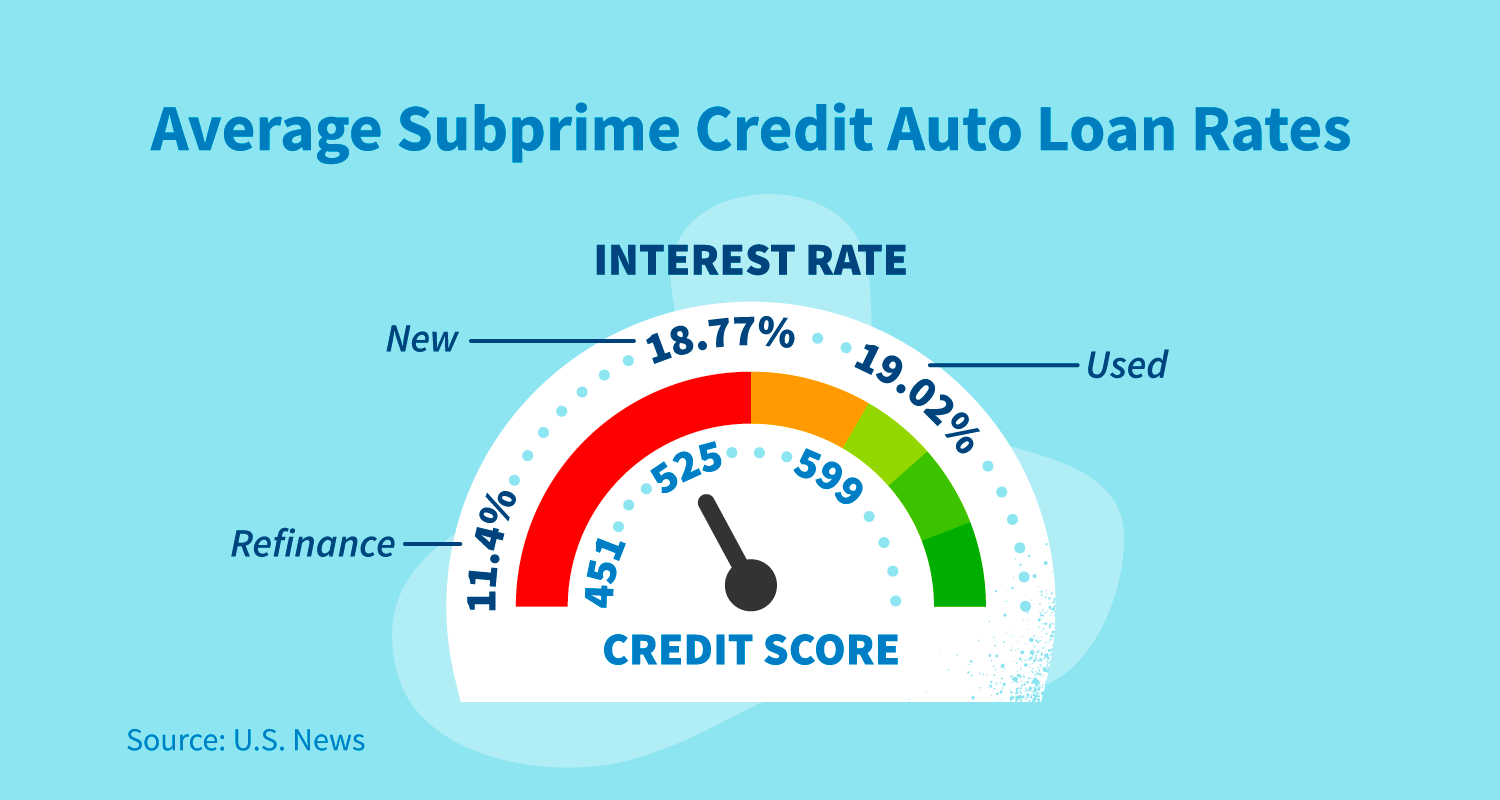

Approved loan providers need to fulfill qualifications and you will underwriting requirements one ensure the borrowing from the bank quality of the financing and you can adhere to brand new Declaration towards the Subprime Credit approved of the federal government, and this addresses risks with the subprime finance, like changeable cost, limitations with the interest rate increases, borrower earnings paperwork, and you may unit enjoys that make regular refinancing of your mortgage more than likely.

Yorum Yapılmamış