Small information

- A 672 credit rating is considered to be good because of the VantageScore and you can FICO rating patterns.

- With a decent credit history, you’ve got alot more monetary possibilities and start to become recognized to get more beneficial interest levels.

- You could potentially raise your 672 credit history with uniform, suit monetary patterns.

Fico scores is actually an important equipment used to assist have demostrated the creditworthiness. Why don’t we know what your 672 credit score function below.

Information and you can managing the borrowing from the bank

A credit rating try a beneficial about three-fist count one to is short for their creditworthiness. Its put, one of additional factors, from the loan providers to evaluate the possibility of financing money to you, the fresh borrower. A top credit history indicates less chance, that could help you be eligible for loans and you will good rates. Credit ratings typically vary from three hundred to 850, however, according to the scoring design made use of, people wide variety could belong to additional credit scoring groups. Below, i break apart both main scoring habits as well as their particular credit rating ranges.

- Excellent: 781 to help you 850

- Good: 661 so you can 780

- Fair: 601 to 660

- Poor: 500 to help you 600

- Sub-standard: three hundred to 499

- Exceptional: 800+

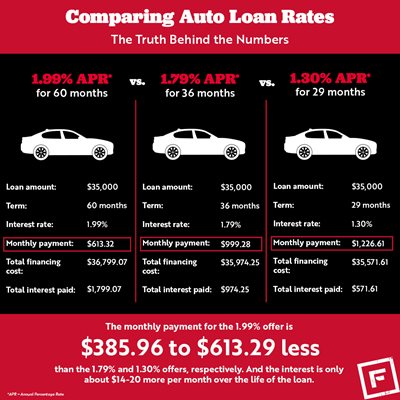

Looking at both get models’ selections, a rating from 672 drops when you look at the good credit rating variety. While this can indicate that one may become a lower risk to help you lenders as opposed to anybody with a fair otherwise worst rating, it’s important to remember that some other lenders could have varying requirements. At exactly the same time, you may find one to a higher still get you could end up down yearly commission prices (APRs), large borrowing limitations and much more.

Credit ratings are influenced by multiple facts, also but not limited to payment history, borrowing from the bank use and you can duration of credit rating. Facts these types of items makes it possible to make advised behavior in order to maintain and further improve your rating.

Exactly what a great 672 credit history setting

Fundamentally, a credit rating of 672 is considered to be perfect for each other chief credit reporting activities (between 661 so you can 780 for VantageScore and you can 670-739 to have FICO). It indicates your odds of having the ability to buy property or take out a car loan try higher than people which have a credit history for the a lowered diversity. You additionally tends to be seen as a lesser exposure applicant getting that loan, and therefore you’ve built a certain level of credit rating and you will possess managed the borrowing wisely and become more likely to get more good conditions.

Buying a house with a good 672 credit rating

To order a house with a beneficial 672 credit history may be you can easily, however it is more complicated than simply if you had an enthusiastic expert credit history.

Whatever you choose, cautiously feedback and you will evaluate some other lenders and you will loan options to pick your very best fit for your unique factors. When you’re important, fico scores are only among the many situations loan providers play with when approving lenders. Generally speaking, certain lenders may need a much bigger down-payment, charges highest rates otherwise keeps more strict loan words to possess home loan individuals they could thought regarding cbre loan services Leeds the a beneficial variety.

Getting most other personal lines of credit having an excellent 672 credit rating

Having a credit rating of 672, you happen to be recognized a variety of version of borrowing, but the conditions and you may terminology you certainly will are very different with respect to the lender as well as your total monetary profile. Credit ratings are important, but there may be additional factors to look at also, such:

Boosting your credit score can increase the likelihood of acquiring an excellent credit line with an increase of positive words. Let’s talk about some of the ways you can do this lower than.

Enabling boost an effective 672 credit rating

Remember that irrespective of your aims, boosting a credit history will take time. It’s also possible to find it fall and rise because you keep on the road to enhancing your creditworthiness. This really is normal. Will still be diligent and you can patient in your method to adding best practices getting economic wellness because you keep working with the enhancing your score.

In conclusion

Building a positive credit history takes time and you may fit monetary designs. Regardless if you are simply getting started on the financial excursion otherwise has viewed ebbs and you will moves on your rating, a beneficial 672 credit history countries throughout the a beneficial set of the newest Vantage and you may FICO habits. Although not, you could potentially continue to help improve your own rating and get much more favorable mortgage words of the constantly applying fit financial habits.

Yorum Yapılmamış