In the event that Phillips didn’t qualify, Blackmon authored — which have apologies in order to folksinger Arlo Guthrie — why didn’t the bank say-so with “mathematic equations, cake charts, and you can pub graphs, most of the to the 8 because of the ten glossy photographs papers, that have sectors and you can arrows and sentences on the back detailing per profitable amount”?

“Often, only the courts of legislation might include the fresh taxpayer. Someplace, people needs to operate,” Blackmon wrote when you look at the a good five-web page Late. 2 order in the Carroll Condition Superior Court. “Well, possibly has become, and lay is the Great State away from Georgia. This new defendant’s actions to write off is actually hereby refused.”

Blackmon’s buy shot down You.S. Bank’s request in order to get rid of a grievance from Georgia homeowner Otis Wayne Phillips, that has attempted to rating home financing amendment throughout the lender. Phillips cannot become hit for it facts.

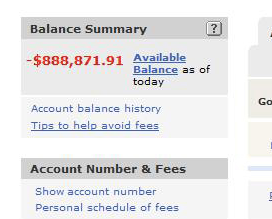

The order lies the actual situation out along these lines: Phillips is in danger of foreclosure. You.S. Lender is one of the “badly work at organizations” one to recently obtained huge bailouts regarding the authorities and concurred to sign up the latest Obama administration’s Home Sensible Modification Program. “

HAMP assistance require banking institutions to look at home owners for variations once they has reached threat of shedding trailing on the payments on account of a monetaray hardship just in case the month-to-month mortgage expenses take more than 30 % of the earnings.

“So it legal usually do not think why U.S. Lender will not create known to Mr. Phillips, an excellent taxpayer, how his amounts lay him beyond your federal guidance for that loan modification,” Blackmon continued. “Getting $20 billion out-of taxpayer money try no problem to have U.S. Financial. A cynical judge might believe that it whole activity so you can dismiss try a desperate try to prevent a knowledge several months, where U.S. Lender will have to tell Mr. Phillips how their financial predicament didn’t qualify your to possess an excellent modification.”

“Perhaps You.S. Financial don’t possess the $20 billion kept, and so the insufficient written reasons could be attributed to some type of ink reduction program to save cash,” Blackmon continued. “Clearly, U.S. Bank usually do not make the money, price with the help of our bodies to include a help towards the taxpayer, break one to agreement, immediately after which say nobody on earth is sue them to own they. That is not what the law states in Georgia.”

“It just demonstrates this new rage of courts towards arguments becoming complex from the home loan servicers continuously and over once more,” New york attorneys Max Gardner told HuffPost. “I believe you could find the fresh frustration into the find all four corners of the buy.”

Since the the discharge in ’09, our home Affordable Amendment system could have been full of issues out of missing files and you can miscommunication off banks’ mortgage upkeep divisions. A lot fewer people have obtained long lasting modifications than simply were booted of the program. Banks can use a keen opaque “Online Expose Worthy of” shot in order to refute a homeowner if an amendment could be reduced profitable than simply a property foreclosure.

Home owners keeps brought a wave regarding still-constant lawsuits facing banks to own financial maintenance abuses, and you may an excellent coalition off state attorneys general is now negotiating with the largest banking companies to own funds that would change the loan maintenance globe and provide specific rescue to people. One settlement, in the event it actually happens, wouldn’t prevent individuals off processing their own claims, no matter if Gardner recommended banking institutions can use it as leverage from inside the court.

Blackmon’s buy states Georgia law allows claims to own infraction out of a great obligation of good trust and you will reasonable dealing, hence there’s two agreements at issue: the brand new bank’s contract to sign up HAMP and its own financing having Phillips. The actual situation is originating to an effective jury demo. “When you are hard to determine, jurors know good-faith and you can fair coping when they notice it, and jurors can see the absence of same.”

When Phillips removed an amendment, the financial institution rejected his consult “without amounts, rates, or factor, reason, research so you’re able to guidelines, or something

“The brand new court’s acquisition contains a great amount of factual and legal problems,” Joyce said. “On broader issue, property foreclosure is almost always the final resort getting borrowers as well as the lender. That’s why we’ve caused thousands of consumers across the country into switching their mortgage loans to enable them to carry out the repayments and you may stay static in their houses.”

Yorum Yapılmamış