Certificate: A personal debt software of a loan company. Once More hints you get a certificate out of your borrowing partnership (usually specific several from $500 or $1,000), you will be lending they that count to own a certain several months, by which you are able to secure a specific amount of interest. If you need your finances right back very early, you’ll will often have to invest a punishment.

Charter: Regulators authorization accomplish providers. A cards connection or other financial institution must have a rental that have a state or even the national.

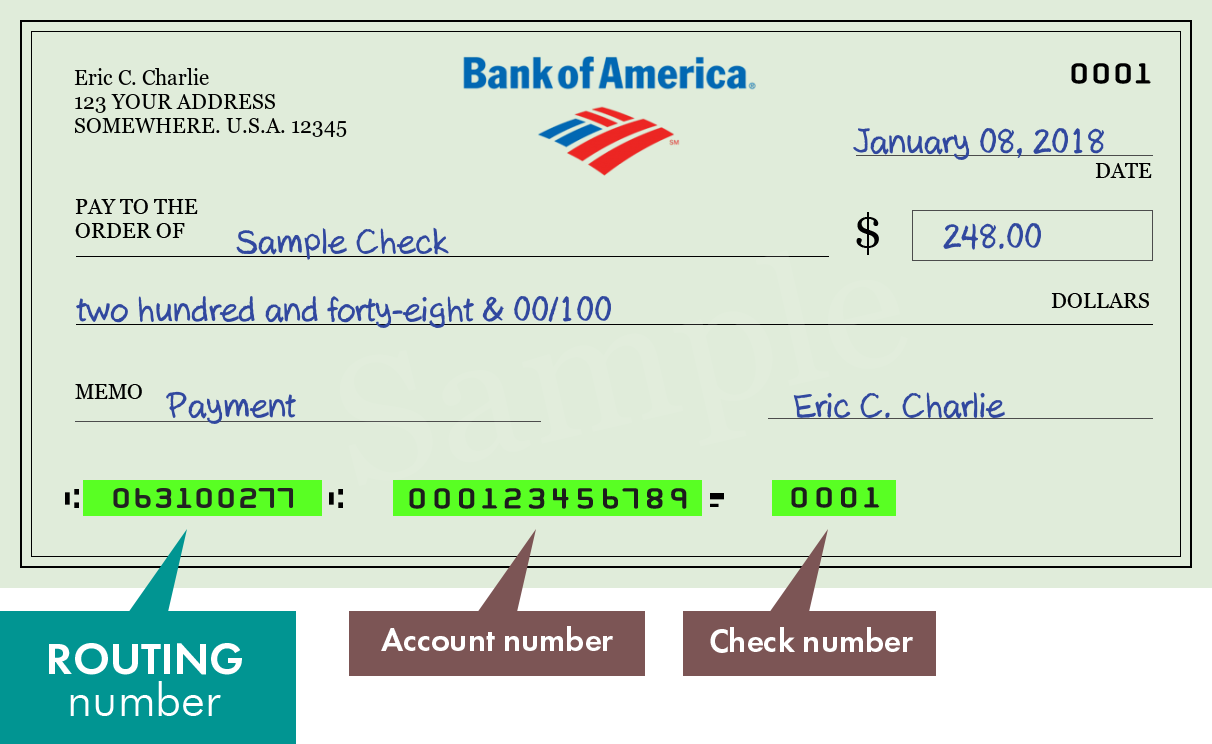

Check: A file one to promises to pay a certain number of currency, obtained from cash on deposit, in order to a specific team on consult. Certain borrowing from the bank unions label a a share draft.

Look at register: Brand new written number you keep of checks since you build all of them and the deposits you will be making in your family savings. Per month should you get the family savings statement, you should get together again your account to know the most your can also be write monitors getting without being charged a beneficial nonsufficient funds penalty. Rather, you could potentially display your bank account equilibrium.

Savings account: An agreement enabling you to build a seek out payment away from dumps in a lending institution. Particular borrowing from the bank unions call a bank checking account a percentage write account. Company examining is the reason smaller businesses are available.

Collateral: A secured item your use in that loan agreement just like the something that you will provide right up otherwise pay back a loan

Instance, the new equity towards a car loan is often the vehicles alone. If not generate costs on time, the financial institution takes the vehicle market they to pay off the financing.

Commission: A fee an investor will pay an agent having doing an exchange-selling or buying inventory. The new percentage is generally a flat fee-state $75 a swap, it ount each show from stock active in the exchange, otherwise it can be in accordance with the full property value the brand new deal.

Commodity: A good otherwise worthwhile target. Whenever found in mention of the exchange, products are bulk-produced items very popular which they vie in the business just on rates, maybe not manufacturers’ names. A good example is corn futures.

A familiar bond distinguishes users, that happen to be eligible to discovered qualities out of you to definitely borrowing partnership, on the majority of folks. Come across realm of registration.

Material attract: Attract determined not just on the completely new dominant (def. 3) that was conserved in addition to to your attention generated earlier and leftover regarding the account.

Material months: Committed one elapses ahead of debt organization pays notice/returns in your opportunities. Different profile features some other compounding symptoms-each day, month-to-month, every quarter, or a-year. More constant the fresh compounding periods, the faster the bucks in your account increases.

Consumer Rate List (CPI): A way of measuring deflation one computes the change on the rates regarding a fixed number of goods and services, also homes, energy, food, and transportation. The government publishes the CPI, and this is known as pricing-of-way of life index, monthly.

Prominent thread: Characteristics, eg boss or neighborhood, you to link the people in a particular credit partnership

Cooperative: A plan where per new member is part holder regarding an investment or group of property. Like, men and women have formed a beneficial collaborative (sometimes known given that an effective “co-op”) to democratically share ownership out-of a corporate or flat building. A credit commitment is actually a monetary collaborative.

Corporation: A form of providers business that can be acquired independently from its people. A corporation possess a rent offering they legal rights and requirements one to manage its customers by limiting the prospective obligation and you can losses. Corporations improve funding and distribute possession of the offering offers away from inventory. Nonetheless they pay taxes.

Yorum Yapılmamış