Domestic Collateral Financing Against HELOC. Home security funds provide consumers a lump sum regarding investment that the bank commonly expect to become repaid more a predetermined period of your time. Using an excellent HELOC towards the money spent is largely a great revolving line of borrowing and this can be tapped for the after borrower loves. At a glance, domestic collateral financing (HELs) and you can HELOCs arrive. Build Loans Against Family Collateral Finance A different way to fund the brand new price of the new residence is which have a house equity financing. With this particular variety of mortgage, you utilize the guarantee on your own newest house as the collateral. Therefore, this procedure is the better accustomed generate a secondary residence.

Framework Loan Vs Financial – ConstructionProT.

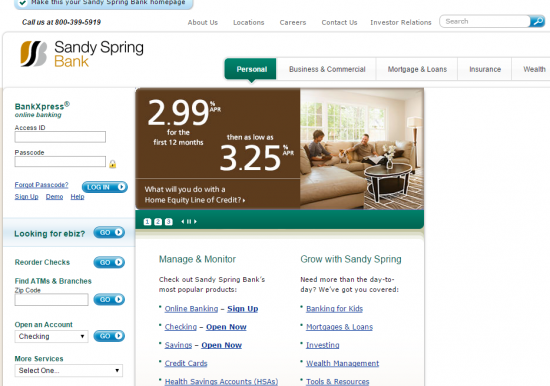

The more collateral you’ve got of your house, the higher interest you get. Anyone which have forty percent collateral might get mortgage loan which is.25 % less than anyone which have 10 percent security. The full debt generally cannot surpass 80 percent of your markets worth, claims Thomas Scanlon, an official societal accountant in the Borgida & Co. inside the Manchester, CT. If you are a resident who wants to availableness the equity instead attempting to sell or refinancing your house, a property Equity Mortgage is the better fits. If you’re in the market for a moment or vacation household, you may use possibly a traditional Home loan or House Security Loan to fund specific otherwise all can cost you. Get in touch with ENB at (877) 773-6605 for additional information on.

A property guarantee loan is a type of loan one lets your acquire a lump sum of cash of the tapping the collateral in your home when using your home as the equity in order to safe the borrowed funds. Although it could help you accessibility money, there was a massive risk to adopt: If you’re unable to pay back your loan, you can eliminate your home.

2nd Financial vs. Domestic Security Financing: What is the Differences?.

You can not transfer domestic guarantee financing so you’re able to a permanent financial just like the its attached to most other assets. Certain buildings loans enjoys mainly based-inside arrangements letting you convert to a long-term home loan, you would need to consult with your lender about this. Dmitriy Fomichenko President Sense Financial 2021 Greatest Home improvement Finance Provide Compare Even offers.

Construction Building work Fund, Household Security & Do it yourself.

Build loans finance the building away from a different home or large renovations to a recently available household. He’s typically quick-name money having high interest rates, built to security the expenses out-of house, plans, it allows and you will fees, labor, content https://cashadvanceamerica.net/loans/student-loan-rates/, and you can settlement costs. However they shelter backup supplies in the event that construction explains funds.

Using Design Loans to have Homebuilding and you will Renovations.

A home guarantee financing are a secured loan backed by their house collateral. step 1 Property improve loan is an enthusiastic unsecured consumer loan. dos Domestic collateral fund provides extended words and you may give higher financing number than simply do-it-yourself loans. As a result, home collateral funds is actually ideal for large plans, when you find yourself home improvement money are best for quick plans. Trick Differences when considering Construction Financing And you will Mortgage loans. Family construction funds was brief-term arrangements one essentially continue for per year. Mortgages, as well, provides differing terms and you can variety anywhere from 5 so you can 3 decades in total. Extremely build money will not discipline you getting very early cost regarding the bill. Financing is the analysis and punishment of cash, money and you can financial support property.It is connected with, although not synonymous with economics,which is the study of production, delivery, and you can consumption of money, property, products or services (new punishment out-of economic business economics links the 2). Financing circumstances occur in monetary systems in the some scopes, ergo the field is going to be approximately divided in to.

Yorum Yapılmamış