For many who be eligible for the VA’s financial gurus but have another mortgage – an FHA financial, such – make use of a Va bucks-out to enter new Va program.

Even after its title, it’s not necessary to just take payday loans in Nauvoo AL cash return; you could use it a simple refinance of your established FHA loan amount. One of the primary positive points to this plan might possibly be removing your own FHA loan’s home loan insurance costs.

Removing home loan insurance policies on Virtual assistant bucks-aside refi

Also decreasing interest rates or reducing monthly obligations because of the stretching your loan term, there clearly was a new prominent need so you’re able to refinance a current real estate loan: reducing financial insurance.

Very low-Va mortgages need some type of mortgage insurance policies you to handles the lending company in the event you standard towards financing. That it insurance rates cover makes financing cheaper, it is therefore not absolutely all bad. But it nonetheless will set you back money per month.

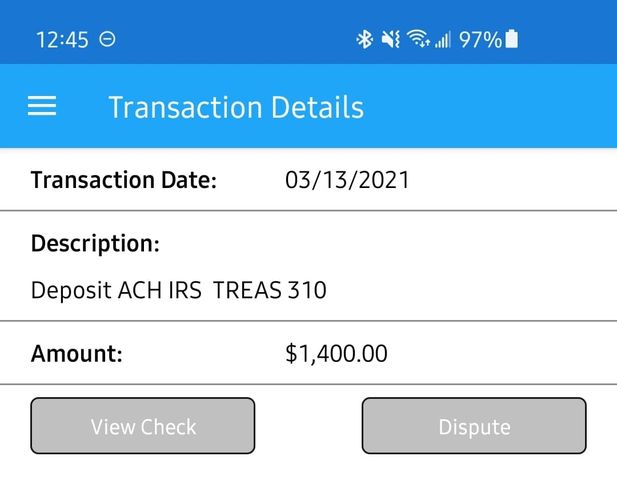

Such, for those who have an effective $two hundred,000 FHA mortgage while generated the minimum downpayment (3.5%), the newest annual financial cost are 0.85% of one’s mortgage value. That can not sound like much, nonetheless it means $ monthly.

Virtual assistant fund none of them this type of ongoing home loan insurance coverage payments. They charge a one-time, upfront funding percentage instead. Thus replacement your FHA financing which have a great Va bucks-out refinance is dump this even more monthly bills.

An excellent Va bucks-out re-finance also can lose individual mortgage insurance rates to your a traditional mortgage otherwise an excellent USDA loan’s lingering be sure payment.

Va dollars-away re-finance prices

The interest rate you earn on your Virtual assistant cash-away re-finance affects the degree of your mortgage payment and you will what you can do to save on your focus payments overall. A speeds which is excessive normally deteriorate the prospective deals.

- Latest rates fashion: Costs was indeed hanging at historic downs in the COVID-19 pandemic, providing customers and you will refinancers spend less enough time-identity

- Your own personal funds: The debt-to-income proportion, credit rating, and you will earnings stability determine your own speed. Individuals having ideal credit users can frequently score down prices

- Your loan proportions: Borrowing to a full worth of your home (100% LTV) will most likely wanted a higher rate since this sort of financing try riskier into the bank

The good news is one to Virtual assistant-supported mortgage pricing tend to be one of several reasonable loan providers can also be offer. However, among Virtual assistant fund, cash-away refis will often have high rates because of their higher risk having lenders.

Only a few Va lenders provide the same cost towards the Va fund, so you should research rates and you will contrast Loan Rates off from the the very least three lenders to discover the best package.

Va bucks-away refinance eligibility criteria

If you’ve made use of an effective Virtual assistant financing to buy your house, you may be already accustomed the fresh Virtual assistant financing program’s conditions. The cash-aside refi’s conditions would-be equivalent.

When you are a new comer to the fresh new Virtual assistant mortgage program, ensure you here are a few their qualifications direction, and additionally sufficient services record, before applying. (All Experts should have started discharged below standards other than dishonorable.)

- Veterans which have an enthusiastic honorable release and you will sufficient armed forces service background

- Latest energetic-obligations servicemembers which have adequate services history

- Latest Set aside and you can members of the fresh Federal Guard (half a dozen numerous years of provider is generally requisite)

- Single enduring partners away from military vets

- Commissioned officials of your Societal Health and Federal Oceanic and you can Atmospheric Government

Va dollars-out mortgage candidates need to fill out a certificate of Eligibility (COE), that the lender can obtain for your requirements, and perhaps, a legitimate DD-214.

If you don’t discover whether you’re qualified to receive the fresh new Virtual assistant domestic mortgage program, name (866) 240-3742 to talk to a licensed lender who can answr fully your inquiries which help you implement.

Yorum Yapılmamış