Of several property owners have received a great forbearance on their Va mortgage repayments inside the COVID-19 pandemic, however the mortgage payments had been deferred and not forgiven. Select NCLC’s Mortgage Repair and Financing Variations several.step three.eight.step three. Property owners who’ve retrieved off COVID-19 challenges will soon be exiting the fresh new forbearance program, after which these people have to address both loans in Lake Park the prior deferred money while the the monthly mortgage payments. This plays additional importance while the moratorium on the foreclosures from Va mortgages is defined to help you expire for the , whether your conclusion time is not lengthened again.

The Virtual assistant recently provided a last code setting out an effective limited allege system one, energetic , lets property owners to resume their brand new regular month-to-month mortgage repayments instead of first paying during the last mortgage payments that have been forborne underneath the COVID-19 system. See 86 Provided. Reg. 28,692 (). So it last code deliver home owners significantly top protection compared to Va got initially set out history December in its earliest proposition to own a final code. Pick 85 Given. Reg. 79,142 ().

The final rule provides this new VA’s limited allege system into alignment with other federally related programs dealing with those exiting COVID-19 relevant financial forbearances. Getting a description of these other forbearance get-off programs come across NCLC’s Financial Servicing and Mortgage Improvement twelve.step three.4.step 3.dos (Federal national mortgage association), twelve.3.5.2.dos (Freddie Mac), several.step three.6.4 (FHA), twelve.step three.8.4 (USDA).

Out-of special notice, backlinks so you can NCLC’s Mortgage Maintenance and Financing Changes twelve.3 getting a restricted big date all are offered to the general public.

This informative article including listings citizen choice whenever a resident having good Va mortgage appearing out of forbearance cannot afford the, regular monthly fees. Such Virtual assistant options are examined in detail within NCLC’s Home loan Servicing and you will Loan Improvement 9.2.2.

Va Allows Further Deferral out of Forborne Repayments, Allowing Borrowers in order to Resume Its Normal Monthly obligations

This new VA’s this new system lets servicers supply a great partial allege solution to Va-protected borrowers to take the money current. The newest limited allege choice is modeled immediately following an extended-condition FHA program. Find NCLC’s Financial Servicing and Financing Variations Section 8. New partial allege involves the financial servicer while making a declare towards new Va for part of the a great financial balance-in this instance this new section equal to the fresh forborne payments.

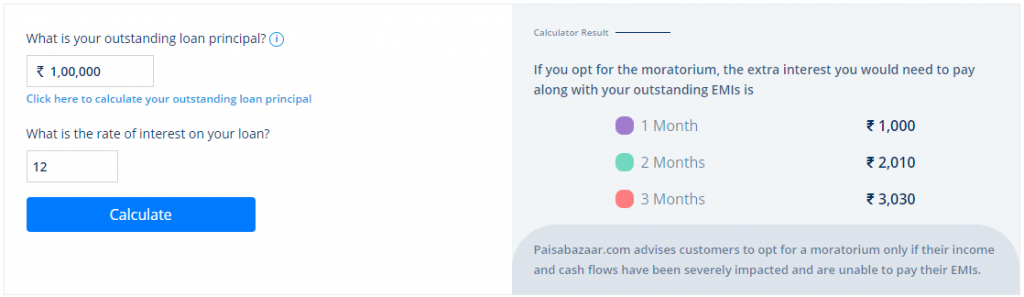

The borrower then owes the brand new partial allege amount to the new Virtual assistant at 0% appeal and just owed at the conclusion of the mortgage mortgage. There are not any monthly installments needed about borrower into Virtual assistant to own installment of one’s partial allege. Following Virtual assistant will pay the fresh new partial allege, individuals resume the pre-adversity mortgage repayments to your mortgage servicer with similar month-to-month payment as till the forbearance.

The limited allege program is present getting Virtual assistant-guaranteed individuals that are exiting COVID-19 forbearance agreements and you may who were latest otherwise less than thirty days past owed by . Individuals have to indicate with the financial servicer they can resume their previous monthly payment. The new limited claim mortgage don’t exceed 29% of one’s loan’s outstanding dominating balance.

The fresh VA’s Latest Rule Is significantly Even more Defensive Than just Their Amazing Suggestion

The brand new Virtual assistant signal going into perception July twenty seven is actually a great distinct upgrade along side VA’s brand-new , proposal. In response so you’re able to comments of a beneficial coalition out-of user supporters provided by National Consumer Legislation Heart (NCLC) while having from the mortgage business, the newest Virtual assistant eliminated numerous difficult have using their brand-new offer.

The newest VA’s brand-new proposition needed individuals to repay this new partial allege within a decade however, did not require one money in earliest 5 years of the name. This means that, individuals still living inside their house would have experienced a significant fee wonder following the earliest five years of partial allege mortgage. Additionally, the fresh Va proposed charging you individuals step one% appeal and limiting how big this new limited state they fifteen% of your own borrower’s outstanding equilibrium. Moreover it needed a full economic documents for borrowers wanting to availability this new partial allege, that will demand a life threatening hindrance so you’re able to borrowers in reality accessing the newest program.

New Va eliminated each one of these problematic financing have and you may instead considering a program based on the FHA’s limited allege system. Come across NCLC’s Mortgage Upkeep and you may Financing Improvement several.step 3.6.cuatro. Through this type of transform, the Va enhanced the amount of assistance consumers can be receive and removed unnecessary traps to being able to access the fresh new applications. VA-secured consumers no further deal with percentage amaze and extra desire repayments.

The fresh new Options for Va Consumers Unable to Pay for The Pre-Difficulty Home loan repayments

New final code delays people obligation to settle for the last forborne mortgage repayments, enabling people to resume their normal month-to-month mortgage payment. The VA’s the latest partial claim system cannot assist borrowers exactly who now do not want to blow their brand new typical mortgage payments. These consumers should think about the new VA’s pre-present mortgage loan modification software in addition to:

- Amendment, in which a lender may customize the mortgage loan of the switching one or maybe more of regards to the loan, for instance the interest otherwise identity, and re-amortizing the balance owed. SeeNCLC’s Mortgage Maintenance and Loan Modifications nine.dos.2.cuatro, 12.3.seven.cuatro.

- Refinancing, where a borrower refinances a top-interest financing on a recently available, straight down speed to your VA’s interest rate avoidance refinancing loan. This new mortgage can also be used discover a smaller title otherwise a predetermined interest or even to fund energy savings advancements. SeeNCLC’s Mortgage Servicing and Mortgage Modifications 9.dos.2.nine.

- Refunding, the spot where the Virtual assistant acquisitions the borrowed funds whether or not it believes that default are healed courtesy various save procedures in addition to financial cannot otherwise reluctant to grant next save. Almost every other losings mitigation solutions can then be around towards homeowner. The fresh Va, such as, may commit to reduce the interest better below the sector rates. New Virtual assistant infrequently even offers this one. SeeNCLC’s Mortgage Repair and Mortgage Changes 9.dos.2.8.

- Compromise sale, the spot where the house is sold so you can an authorized getting an amount decreased to settle the loan and servicer launches the fresh lien and you can waives brand new insufficiency in return for new business proceeds. Moving assistance of as much as $1500 can be acquired in order to individuals who over a damage deals. SeeNCLC’s Mortgage Maintenance and Financing Adjustment 9.dos.2.5.

- Deed as opposed to foreclosure was a volunteer transfer of the assets into proprietor of your Va-guaranteed loan. Relocation advice, labeled as dollars getting important factors, of up to $1500 can be found to help you individuals exactly who effectively done a deed during the lieu of foreclosures. SeeNCLC’s Financial Repair and you may Mortgage Modifications 9.2.2.6.

- Expectation, where bank features forbearance getting a fair time period to allow the product sales or import of the home. If approved, it launches the fresh borrower regarding people upcoming liability on the Va, along with responsibility for the loss as a consequence of the fresh standard of customer otherwise after that owner of the property. SeeNCLC’s Mortgage Servicing and Financing Variations 9.dos.dos.7.

Yorum Yapılmamış