Get a mortgage in the California Today!

During the Safeguards The united states Mortgage, we have been happy to help you suffice anyone who has served our nation. We let veterans as well as their family to gain access to sensible lenders within the Ca, from the Va, making its dream households an actuality.

Are you ready first off your house financing process? Up coming just fill in the small one to-second mode lower than to begin with! We shall provide a no-obligation appointment so you’re able to imagine exactly how much you might be in a position to acquire.

Why would I have a Virtual assistant-Supported Financing when you look at the California?

Having globe-group places instance San francisco and you can La, unbelievable environment all year round, and healthy living, you will find multiple reason why you might want to use your Veterans Loan advantage to purchase your fantasy domestic inside the the fresh new Wonderful Condition.

Concurrently, financing constraints into the Ca may include state to state, according to houses ento’s median list home income price is $520,000 during the 2022. Essentially, Virtual assistant mortgage restrictions come across a https://availableloan.net/installment-loans-nc/milwaukee/ big better-right up in 2022, on the simple Va financing restrict expanding to help you$647,200 than the $548,250 inside 2021. New Virtual assistant loan limitations and improved to have large-costs areas peaking in the $970,800 to own just one-family home. Remarkably, Va loan limitations is actually inadequate to possess licensed pros that have complete entitlement. not, the fresh new limitations however affect pros in place of full entitlement.

Along with, VA-Backed Finance require a good 0% deposit oftentimes, whereas conventional loans basically require at the very least good 3% deposit and regularly up to 20% required; FHA finance need no less than 3.5% deposit. And you will, that have an effective Virtual assistant Financial, pros do not need to shell out people month-to-month mortgage insurance policies, and this can not be said throughout the old-fashioned or FHA mortgage loans.

What exactly is good Jumbo Financing for the Ca?

Of numerous Experts have already rooked its Va loan benefits. Which have everyday degree requirements and much more autonomy, its shown to be the best choice for the majority to pick and you may re-finance their homes through this program. Although not, in some Ca areas, the fresh conforming mortgage restrict without currency off are $548,250. In case the home will cost you over this, the solution is good Va Jumbo Mortgage. A great Virtual assistant Jumbo Loan is people Va-Backed Loan larger than $548,250. And you can qualifying Experts can put on to order or refinance their residence for as much as a value of $1,000,000 from this version of loan, and additionally researching the benefits of the general Ca Va Loan.

These are the Secret Gurus that Coverage America could offer your to find a beneficial Va Funds in the California

- Virtual assistant, FHA, and all of Home loan Items.

- $0 Deposit to possess Virtual assistant Lenders.

- No need to have Individual Mortgage Insurance.

- Competitive hobbies costs.

- All the way down Repayments.

- Simpler to Be considered.

- Casual Borrowing Criteria.

Va Mortgage Overview

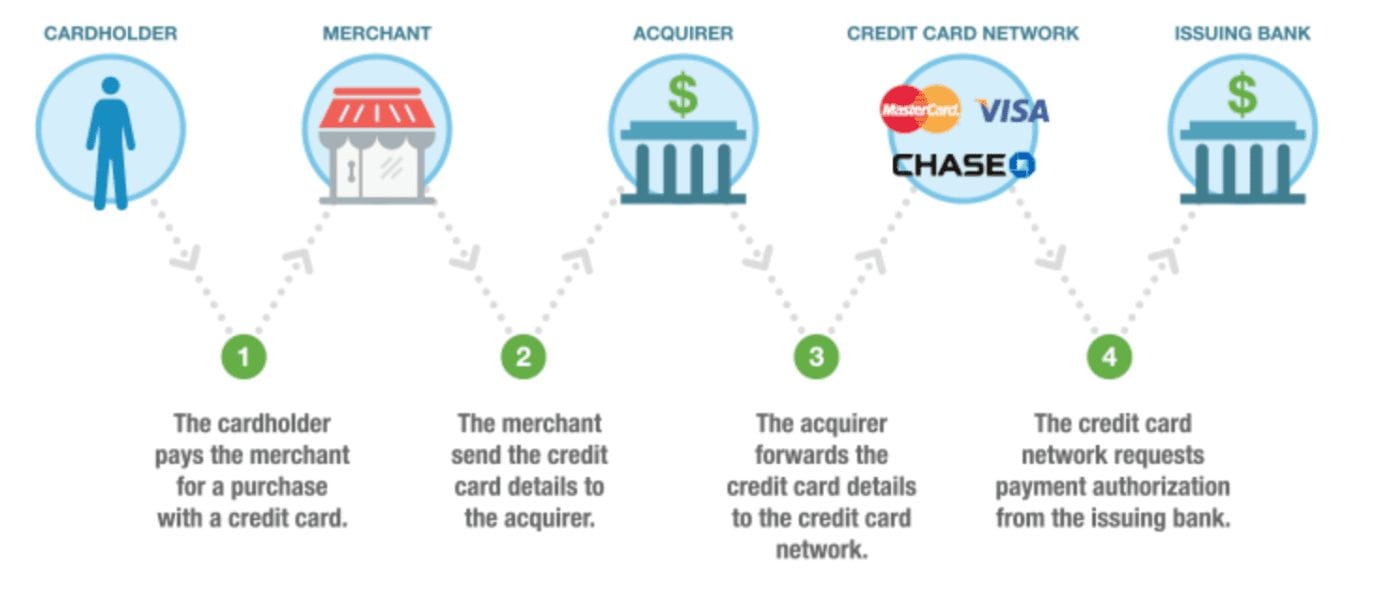

Ca Va Mortgage brokers was loans supplied to military experts, reservists, and you may effective-obligation members to find a first house. This new Pros Government doesn’t provide money on home loan; rather, it promises the big 25 percent of one’s loans produced by individual lenders, instance Safeguards The usa Home loan, to people compliant into the Va Financing Qualifications requirements.

Licensed veterans can use their financing advantages to purchase a house which have zero currency down, no individual financial insurance rates, and also have the manufacturers pay all their closing costs. Such positives and you may extremely aggressive interest rates create Va Finance from inside the Ca, the most popular loan selection for many pros.

Va Home loan Rates and you may Will cost you

Virtual assistant Money for the Ca have a similar costs associated with closing since the another mortgage facts, however, there are two trick variations in closing costs that have a beneficial VA-Supported Loan. Earliest, in the event the discussed on the pick bargain, the seller pays every closing costs and you will prepaid service things, totaling around four per cent of your price. Next, the brand new Service away from Experts Circumstances costs a beneficial Virtual assistant Financing Fee into the the mortgage it guarantees.

The newest Va Capital Fee is reduced to the Virtual assistant and you can really helps to pay money for the house Mortgage Program for everybody most recent and you may upcoming homebuyers. This Fee selections from one.25 % to 3.step 3 % but is waived to own veterans that have service-connected disabilities. As well as, the newest Va Money Commission can be paid-in full or rolled towards financing during the closure.

Generally speaking, the attention rates to possess Virtual assistant Money when you look at the California are lower when compared to the antique and you will FHA funds. Still, you can travel to our very own Virtual assistant Finance calculator so you’re able to determine your instalments!

Yorum Yapılmamış